What is Notional Bank concept in Tally?

National Bank is an unreal bank account to record temporary transactions to it. The user can opt to record their PDC Receipts to a Notional bank. This occurs, in case if they are not clear and going to decide subsequently then they can put it in Notional Bank. Later they have an option to change the bank to which it should be deposited. However, values will be reflected to accounts.

Note: In the year end, user need to ensure no balances are showing under Notional Bank.

Enabling Notional Bank

A notional bank exhibits the same features as a normal bank account, created under the group Bank Accounts. You can create a notional bank account when you are:

Unable to decide the bank to which the post-dated cheques received are to be deposited, while creating the post-dated transactions.

Manually converting the post-dated cheques received.

Unable to determine the bank to which the post-dated cheque is to be deposited.

To enable notional bank

1. In F11: Features > Accounting Features, enable the option Set/alter Post-dated transaction features to Yes.

2. Select the bank account for transacting with post-dated cheques.

Passing PDC Transaction for Notional Bank

Usually P D C receipts can be recorded through Notional Bank. Whenever users receive P D C from their party, on the date of P D C receipt, as they are not sure to which bank they are going to deposit, they can put it under Notional Bank. This will not get regularized automatically. Users need to regularize manually.

When P D C is received, pass a receipt voucher marking with Post-Dated by debiting Notional Bank as shown below:

In the bank allocation screen PDC/Voucher Date will be captured in Instrument Date field. Also PDC Receipt date captures the Current/System Date (on which PDC was received, this field can be editable), as shown below:

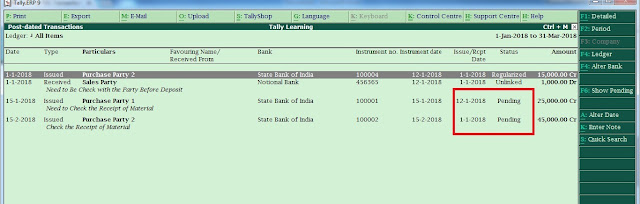

When on specific date, user has option to view P D C Report (Alt + T) from Day Book:

Here we have to take action on status of the Cheque:

By changing the period, user can even view P D C transactions of future dates:

Status:

These cheques (issued/received) have got regularized today, however user need to ensure:

Cheques which were received need to deposit to respective bank.

Unlinked:

If received cheques are under Notional bank, then user needs to move those to regular bank. Then status of cheques will get changed to Regularized.

Pending:

These are the cheques which Date is yet to occur. Pending status transactions will get be Regularized based on Date of Last Entry.

P D C Note can be viewed by enabling from F12: Configuration. Here the transaction status ‘Un-linked’ need to be take action. Therefore, user has to move ledger from Notional Bank to regular bank.

Keep a cursor on Unlinked transaction > press Space-bar to select > click on Alter Bank (Alt+F4) as shown below:

Select the regular bank from the list of banks and press Enter to save changes

Now the status will get changed to Regularized:

Note: User can even change the Voucher Date (Alt+A Alter Date) of issued/received PDC based on business scenarios. For e.g. If party is request to deposit Cheque after 2 days or you may request your vendor to deposit Cheque after a week. However Date written on Cheque will not be affected.

Any Further Queries please feel Free to Contact us:

goodwilllearningworld@outlook.com

No comments:

Post a Comment